Veri / Human Engineering

Founders: Anttoni Aniebonam, Verneri Jäämuru, Frans Lehmusvaara

We are a sector agnostic early-stage investor that wants to partner with founders from the very beginning of their journey and support them throughout their growth. Our team has global experience in building and scaling companies both as founders and in various CxO roles. We invest in ambitious and determined teams that can one day become industry leaders.

Swarmia, a software team productivity company, has raised €5.7 million in seed funding. The funding will be used to scale to the US and the company will be hiring developers, growth marketers, account executives and many other roles.

Read moreSwarmia is a software team productivity company with a B2B SaaS product for supporting software development teams in their continuous improvement. The Swarmia team has successfully delivered software, and led engineering & design teams in high-growth, fast-moving environments.

CEO: Otto Hilska

Founder: Otto Hilska

Oura has raised $100 million in its Series C funding round. These funds provide Oura with substantial runway for important future opportunities and the company aims to invest in all areas of the business including software and hardware development, people, R&D, as well as marketing and customer experience.

Read moreOura is an award-winning wellness ring and app, designed to help people get more restful sleep and perform better. The independently validated science behind Oura and the design of the Oura ring make it the perfect companion for busy professionals, athletes and anyone who wants to get insights into their sleep, recovery and readiness to perform.

CEO: Harpreet Rai

Founders: Petteri Lahtela, Kari Kivelä, Markku Koskela, Virpi Tuomivaara, Ashley Colley

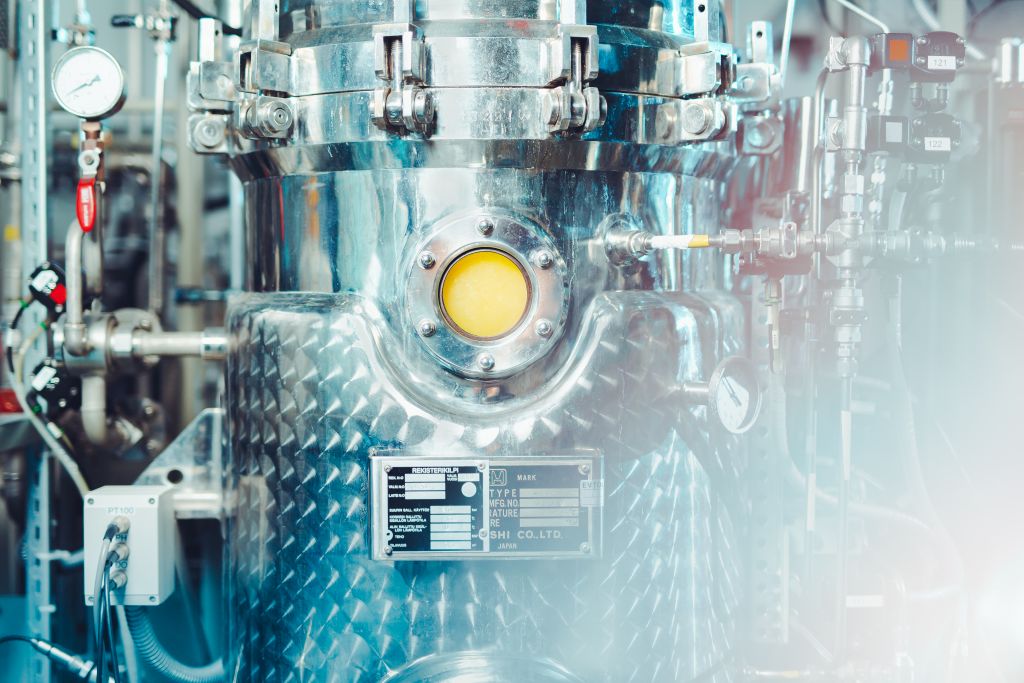

Carbo Culture has raised a new $6.2 million seed financing round. The funding means new resources into people, engineering, R&D and product development. In the coming months, the company will be commencing the engineering works on its technology scale-up.

Read moreCarbo Culture carbonizes biomass waste into biocarbon products for soil and environmental applications. By rapidly converting carbon to a solid and stable form, the company prevents it from escaping back into the atmosphere for over 100 years. The products are frequently used across industries, in agriculture and research.

CEO: Pia Henrietta Moon

Founders: Pia Henrietta Moon, Christopher Carstens

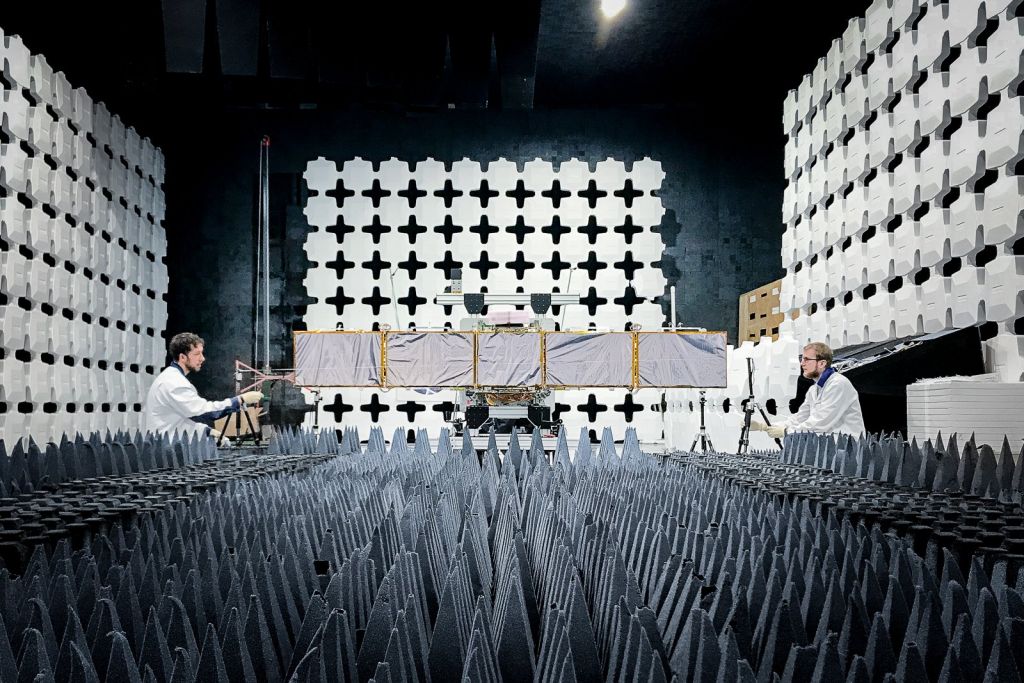

Measur, a company founded by two scientists, Teemu Myllymäki and Kalle Lagerblom, has raised €0.5 million in funding. It aims to become the leading B2B marketplace for laboratory analyses and measurement services. Measur's customers include the most innovative and impactful companies in the world.

Read moreMeasur is a technology company that provides laboratory analyses, materials characterization and testing services and has a portfolio of over 1000 different analysis techniques. The Helsinki-based company serves its local and international customers with over 80 partner laboratories across the globe. The company also commercializes measurements, which are not normally available by organizing the measurements at the local universities. The company was founded in 2017, employs a growing team of experts and is led by its co-founders.

CEO: Teemu Myllymäki

Founders: Teemu Myllymäki, Kalle Lagerblom

We are a registered alternative investment fund manager (AIFM). We are supervised by the Finnish Financial Supervisory Authority.

Lifeline Ventures is a member of the Finnish Venture Capital Association (FVCA) and follows the association’s rules and guidelines.

We follow Invest Europe’s Investor Reporting Guidelines in our investor reporting. The valuation of the portfolio is done in accordance with the International Private Equity and Venture Capital Valuation (IPEV) Guidelines.

Lifeline Ventures Fund I Ky (€28.8m)

Lifeline Ventures Fund II Ky (€17.1m)

Lifeline Ventures Fund III Ky (€57.0m)

Lifeline Ventures Fund IV Ky (€130.0m)

Pension companies: 25%

Funds of funds: 22%

Family offices: 22%

Public sector: 16%

Other asset managers: 4%

General Partners: 4%

Insurance companies: 3%

Private individuals: 3%

Foundations: 1%

Finland: 94%

Rest of Europe: 5%

Outside of Europe: 1%

Samuli Leppänen, samuli@lifelineventures.com

Lifeline Ventures invests responsibly. We follow our responsible investment policy which means that not only economic aspects, but also environmental, social and governance (ESG) issues/opportunities as well as sustainability risks/opportunities are taken into consideration in investment decisions, due diligence and ownership activities. No investments are made if a potential portfolio company fails to meet the requirements of Lifeline Ventures’ responsible investment policy and there is no plan on how to address the ESG issues and sustainability risks. Where appropriate or deemed necessary, external advisors will be used for additional due diligence relating to ESG and sustainability risks. The evaluation of ESG and sustainability risks/opportunities is done on case-by-case basis and we focus on the matters that are relevant to the potential portfolio company and its operating environment. Sustainability risks mean environmental, social or governance events or conditions that, if they occur, could cause an actual or a potential material negative impact on the value of the investment.

Lifeline Ventures will not make any investments in companies focusing on any of the following: tobacco, nuclear energy, pornography, arms industry or arms trading, animal or human cloning, or gambling industry. In addition, we will not invest in companies or founders which we determine to operate unethically. We see ESG-related opportunities as a potential source of competitive advantage for a portfolio company and thus they have a positive impact on the investment decision.

Lifeline Ventures does not currently consider adverse impacts of investment decisions on sustainability factors within the meaning of Article 4(1)(a) of the EU Regulation 2019/2088 on sustainability‐related disclosures in the financial services sector. We act in accordance with the Article 4(1)(b) of the EU Regulation in question for the time being as there is uncertainty surrounding the content of the obligation set out in Article 4(1)(a) and because our adverse impact is likely to be very small or not measurable taking into account the size, the nature and scale of our activities and the types of financial products we make available. Lifeline Ventures intends to consider such adverse impacts when further information on the requirements is available.